Every year, around this time strategists put together projections taking a bull or bear stance as the sound of the first opening bell rings in 2015. After a 6 year run, a PE multiple marching steadily higher, a wave of buybacks that can’t last and a Fed heading to the exit, it’s easy to conclude the party is coming to an end. While there’s no shortage of economic and geopolitical concerns including the possibility of military conflict, I’m ready to say the Bull Market continues because, “IT’S DIFFERENT THIS TIME.”

As we close out the final days of 2014 it’s easy to look back and identify the events that helped push the market to new highs. Which of these themes will carry into 2015 and what challenges do we face as we head into the New Year? That’s the hard part.

Energy

The top of anyone’s list of market moving events has to include the over 45% drop in oil prices just since June. We’re six months into the correction and today oil sits close to multi-year lows. The fall of OPEC and with it the cartel structure that supported oil prices the last 40 years gets my vote as the most significant event since the financial crisis.

Have we entered a new era for energy prices or is this just another run of the mill correction veteran traders will tell you they’ve seen all too often. While there’s evidence to support both sides of the debate I’m ready to say; “IT’S DIFFERENT THIS TIME.”

There’s obvious benefits to cheaper energy but make no mistake, there’s a dark side as well. If low prices persist there will be a huge transfer of wealth worldwide. Some oil exporting nations need oil at $100 or higher to make ends meet. Credit default swaps for Venezuela’s sovereign debt already are starting to price in a default.

Russia whose budget continues to consume over 50% of its oil export revenue is a much bigger problem. Instability in any part of the world is a concern but when it’s a nuclear power like Russia whose President continues to make irrational statements, the conversation takes a different tone.

Even here in the United States cheaper energy isn’t all good news. As I pointed out in Oil & the Black Swan the junk bond market has a 16% exposure to energy and some oil rich states like Texas are starting to feel the budgetary pinch.

The transition to lower energy prices won’t be without incident as past winners won’t go down without a fight. Despite these dangers, ultimately lower prices will be a net positive for the world community. Here in the states consumer savings, lower cost of goods sold and a tailwind to GDP are just of few of the benefits.

Source EIA (Energy Information Agency)

Low oil prices are a welcome relief to countries heavily dependent on oil imports. China, Japan, India, South Korea and Germany should all see a boost. At what price oil finds equilibrium I can’t say. Whether it’s 40, 50, 70 or $80 a barrel, oil as a free floating commodity should see a lower range of prices that could last for some time.

Canaries?

Anyone who runs money looks for tells or signals that can act as an early warning sign. Treasury yields and utilities are often used as market canaries to see if it’s safe to jump in the water. With almost every spike lower in the 10 year yield, stocks took it on the chin. The chart pitting the 10 year benchmark yield against the S&P 500 shows the relationship clearly.

Falling over 9% in Mid-October the SPX briefly gave back the entire year as the 10 year breached 2% falling as low as 1.86%. Often crashing yields can be a harbinger of bad news but at least here in the states, I’m ready to say; “IT’S DIFFERENT THIS TIME.”

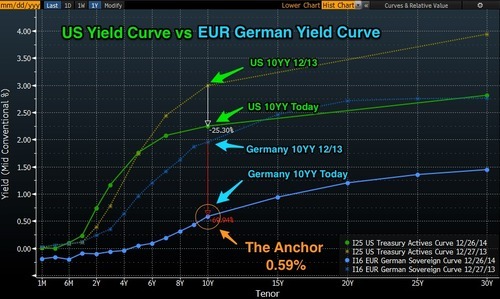

The problem isn’t here in the U.S., its Europe. The chart comparing the US & Germany’s yield curves lays out the thesis. Euro bonds are still high quality paper and act as an anchor. How can our yields move up with the German 10 year at 0.587%?

Utilities are another market canary and hiding place for investors. The surprising strength of this sector caught many strategists including yours truly flat footed early in the year. The inverse correlation between yields and the SPDR Utilities Sector ETF (XLU) is undeniable but even here I’m ready to say; “IT’S DIFFERENT THIS TIME.”

In 2014 even during periods of rising yields utilities have had a bid pushing Friday to another all-time high. I rarely find myself on the same side of an issue as Jim Cramer but Jim makes a good point recently on CNBC’s Squawk Box saying; “…it’s highly unusual to see this group go up with interest rates going up. It has to do with business getting better, with industries using more power…”

What Needs to Change

It’s no secret the market’s 6 year run at least in part has been fueled by a nearly endless series of buybacks. The Harvard Business Review reported back in September that from 2003-2012 companies within the S&P bought back $2.4 Trillion in stock. At some point corporate buybacks are a net negative for investors. Companies who prop up earnings using buybacks at the expense of R&D and CAPEX eventually turn into IBM and investors soon find out The Emperor Has No Clothes. The next leg of the bull market won’t come from financial engineering.

Next year I’d like to see buybacks lower, R&D and CAPEX higher. It’s time for U.S. corporations to start re-investing in the company and with it an investment in America.

Is GDP Finally Starting to Break Out?

My recent comment from CNBC Closing Bell. The market is a wonderful discounting mechanism. All year long as the market hit new highs we found ourselves asking why and then we get a number like the recent GDP revision for the third quarter and that’s the confirmation. Pushing toward 5% is a big deal.

Moving Targets

Coming up with precise targets for the market is difficult at best. It’s always the unknown that changes our calculus sometimes forcing us to re-think strategies.

I’m going to use the same math I used last year for 2014 to come up with my 2015 target for the S&P 500. Despite a 1st quarter setback in May I told CNBC Closing Bell Anchor Bill Griffeth my baseline target for the SPX was 2000. To get there I took the current 12 month forward estimate and multiplied by the trailing multiple. That worked pretty well so let’s go double or nothing.

Current consensus for 2015 S&P 500 earnings has a range of $126-$127*. Let’s use the mid-point and multiply by the likely 2014 trailing PE of 17.8. That gets you to about 2250 as a baseline target.

Every market cycle has similarities but they also have their unique differences and that’s certainly true for the coming year. Yes, there are challenges ahead and along with them opportunity. For 2015 “IT IS DIFFERENT THIS TIME.”

It’s always different.

*Reuters