Wall Street’s love affair with stock buybacks grows deeper with each record high. Who can blame them? The S&P 500 Stock Buyback Index which measures the performance of the top 100 stocks with the highest buyback ratio has massively outperformed its index sister over the last 5 years.

In a mindset where the only thing that matters is price performance it’s hard to argue the merits of a program that’s rewarded shareholders so handsomely. However, when you look a little deeper and discount management hype, we soon find not only are stock buybacks often abused by management to drive their own agenda, they can eventually put stock returns at risk.

Poster Child

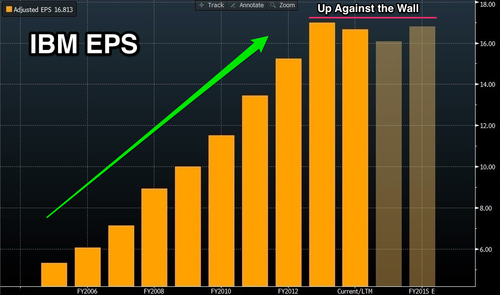

IBM is the poster child of companies using buybacks to hide deteriorating fundamentals. Averaging close to $13 Billion in annual share repurchases management seems to believe they can hide the fact that they aren’t growing. On October 28th they announced they were tacking on another $5 Billion to their existing buyback program, adding to the insanity. If they continue on this course unabated even die hard investors like Warren Buffet will abandon ship.

4 Ugly Charts

IBM’s Revenue has declined by $10 Billion annually since 2011 while total debt has steadily climbed to over $46 Billion. Cash and cash flow from operations have been declining since 2007 and 2011 respectively. Operating income peaked in 2012, yet like clockwork Big Blue keeps buying back stock. Think about it. They’ve bought back almost $65 Billion worth of stock since 2009*.

All this is being done to keep earnings growing and as you can see up until recently it’s worked pretty well. IBM has been able to grow the bottom line double digits for the last decade with little or no revenue growth. Buying back stock and cutting their way to profits has been the rallying cry of management determined to hit a $20 annual EPS. Unfortunately they’ve hit a wall and 2014 will be the first time in recent memory EPS will be down year over year.

The Cloud

Barclay’s Ben Reitzes nails it when he said in a recent note that IBM’s cash flow has been telling us for two years they are having trouble shifting to the cloud.

What’s their Plan? If the buying back of all this stock is part of a grand scheme to get smaller it hasn’t been articulated to the street very well. At some point just shuffling your workforce and looking for ways to cut costs doesn’t work. The company will likely have to come clean next year and reset expectations.

While IBM has a balance sheet that can still grow, one thing is certain. This is a game with a finite horizon. Eventually, a company with flat revenue, rising debt and falling cash can’t continue to buy back stock.

Instead of trying to financially engineer your way to profits why not put more money into R&D. If you can’t grow it internally, buy it. Invest in a bunch of small promising companies but do something before investors discover The Emperor Has No Clothes.

The Truth

The truth is, many CEO’s and the management teams are sometimes too focused on the near term. Investments in R&D and CAPEX often have long payback cycles. Future CEO’s may end up reaping the benefits from an investment made today, long after the current management is gone. Stock Buybacks are one of the quickest ways to goose near term earnings, helping management meet performance goals giving them a bigger piece of the stock compensation pie.

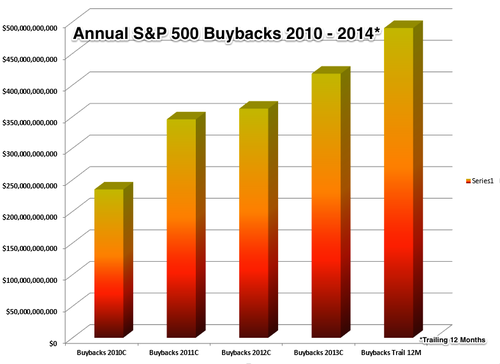

It’s no secret that U.S. companies have more than recovered from the depths of the financial crisis. They are flush with cash and as I said in yesterday’s post “The Twelfth Round”, it’s understandable that management would pick the low hanging fruit. If your top and bottom line is struggling, just buyback more stock decreasing your share count boosting EPS (earnings per share).

For some companies, especially in the Tech sector stock buybacks are a must to offset dilution from stock based compensation programs. More than $5.9 Billion of Cisco System’s (CSCO) buybacks* from 2010-2013 went to offset the dilution from stock based compensation.

From the end of 2009 to the present Stock Buybacks just within the S&P 500 have climbed more than 100% to $490 Billion* annually. Goldman’s Portfolio Management Team believes 2015 will come in much higher, writing they expect to see $707 Billion in stock repurchases.

Not All Buybacks Are Made the Same

Buybacks aren’t always bad, especially for companies whose capital structure is out of line. Apple (AAPL) whose cash on the balance sheet is a staggering $155 Billion needs to return cash to shareholders.

While there’s still enough gas in the buyback tank to push markets higher at some point the well runs dry. Long term sustainable growth can only be achieved by companies reinvesting in their future. The next leg of the Bull Market will be driven by CAPEX, not another round of financial engineering.

*Source Bloomberg

** At the time of this article funds managed by David Nelson are long Apple (AAPL)