By David Nelson, CFA

This chart of the German Dax took on a life of its own when I posted it on Twitter last night. After many retweets and favorites I knew I had to share it with the Yahoo audience.

As always Sunday is a big research day giving me a chance to reflect and focus on the coming events of the week.

As I went through the data one chart just jumped off the page. The German DAX which had pushed just above significant resistance on the 16th of January exploded higher as we approached and passed last week’s ECB decision.

After being stuck in a 1 year trading range the DAX has made a monster breakout. Ask yourself this question. If this chart was a stock would you buy it? I think the answer for many would be a resounding YES!

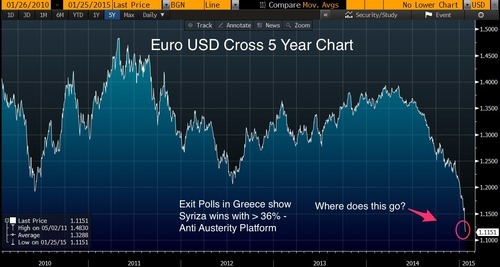

By most accounts Draghi’s announcement went beyond what many investors were looking for. Pumping 60 Billion Euros a month into the economy will keep continued pressure on the Euro which is sitting at 12 year lows. Of course this is likely good news for German exporters in the same way a falling U.S. dollar helped our industrial complex coming out of the financial crisis.

Was it a relief rally or does this really have legs? Only time will tell but you have to be impressed with the price action. It certainly commands my attention.

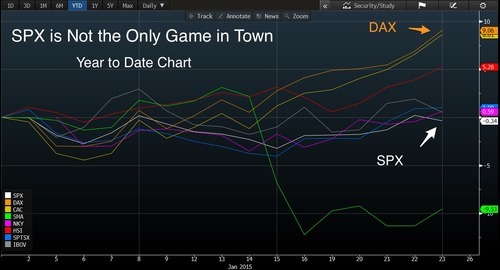

The U.S. Is Not the Only Game in Town

A quick look at a performance chart shows that the US is no longer the only game in town. The DAX and CAC 40 are up over 8% YTD while the US struggles to regain breakeven on the year. Our tactical strategies have been out of international stocks since 2013 but the triggers to enter are getting very close.

It’s All About Currency

Since most reading this are U.S. investors we have to discuss currency when talking about any international investment. As you can see while the year to date performance data for Germany and France look impressive in US Dollar terms there’s little to cheer about. The continued fall in the Euro is wiping out returns.

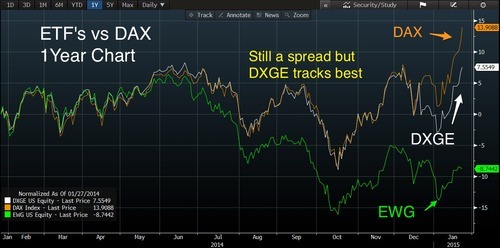

DXGE (WisdomTree Germany Hedged Equity Fund)

For U.S. investors I think the best approach is with a currency hedged ETF like (DXGE) WisdomTree Germany Hedged Equity Fund. In the 1 year performance chart above you can see it tracks the index a lot closer than others like EWG (iShares Germany Fund). It’s not perfect and there is some drift in the performance spread. Hedging has costs associated with it so that could be part of the difference.

Is this the bottom of the Euro? I doubt it but even if it is why take the chance? If you’re looking to add exposure to Germany without taking on currency risk this is the way I’d play it.

As for a stop, choose your own comfort level but have one.