From the speculative mania of tulip bulbs in 1637 to the Financial Crisis of 2008, unpredictable high profile accidents have taken down investors and sometimes even whole countries. As I said in Part 1 of this series, these events often referred to as a Black Swan are only discoverable looking in the rearview mirror.

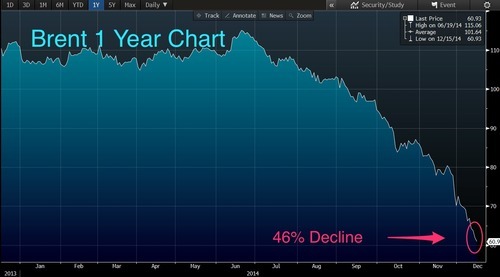

Today’s latest candidate is the over 40% decline in oil prices just since July. While the long term benefits of cheap energy are undeniable, sustained low prices will force a huge transfer of wealth. There will of course be winners but you can bet the losers won’t go down without a fight.

It’s no secret that Iran, Iraq, Russia and Venezuela are in desperate need of higher oil prices to fund their budgets. One look at the credit default swaps for Venezuelan debt will tell you just how dire their circumstances are. While political unrest or economic event could trigger a crisis in any one of these countries, Russia could truly be the home of the Black Swan.

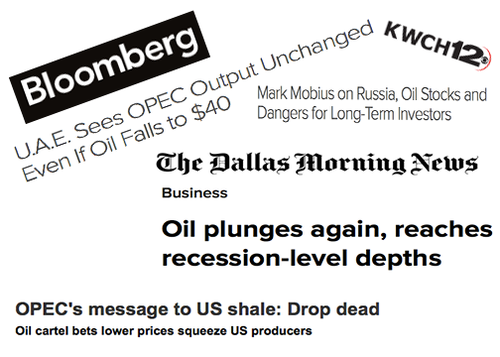

OPEC Suicide

On Thanksgiving Day OPEC effectively committed suicide. For more than 40 years the cartel has dominated energy pricing with its cartel structure. Saudi Arabia, the defacto leader has a long history of being the world’s swing producer able to increase or decrease production to counter balance rising and falling energy demand. With the Saudi’s unwilling to cut production, other member states were forced to fall in line and back the release.

As I told Yahoo Finance Anchor Jeff Macke in last week’s interview, “… not only did Saudi Arabia fire a warning shot over the bow of the U.S. Energy Complex… they are announcing they will no longer subsidize Iran, Iraq, Russia or Venezuela.

Russian Crisis

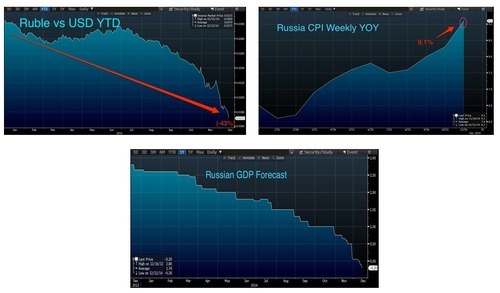

With a budget that consumes 50% of its oil export revenue, 9% inflation and a currency down 42% this year, the Russian economy is rapidly slipping toward recession.

Credit Default Swap spreads have been an issue for Russian Debt investors all year especially, as sanctions started to take hold. As you can see in the chart below, the inverse correlation is undeniable when credit default swaps and oil are plotted side by side. As oil plummets the CDS curve goes parabolic.

Forced to support a failing currency and rampant inflation Russia’s central bank increased borrowing costs to 10.5%. Goldman analyst Clemens Grafe in a recent note said the 100 basis point hike was above their call for 50 but below street expectations of 200 bps.

Russian economic forecasts are anemic at best. Alexey Devyatov of URALSIB Capital says: “We believe that Russia’s economy is now on the brink of recession, and that a recession will only be avoided if there is an immediate recovery in oil prices.” He goes on to say “Russia’s GDP may contract as much as 5% next year.”

The bigger concern may be Mr. Putin himself. With each stair step drop in oil prices and the Rubel he grows more desperate and irrational. He takes no responsibility for his actions and has even accused the west of acting like Adolf Hitler. I’m not comforted by the fact that the wounded Russian Bear still sits on a stockpile of 8500 nuclear warheads of which 1800 are strategically operational.

President Putin has made no secret of the fact that his goal is to return Russia to its pre cold war glory days. Following his invasion of Crimea and the Ukraine a wave of nationalism has supported his popularity. That could evaporate quickly as the country slips into recession or the currency crisis picks up steam.

Russian Default?

If present conditions continue a Russian Default isn’t only possible but probable. It wouldn’t be the first time. Wikipedia describes the Russian Crisis of 1998 as follows: Declining productivity, an artificially high fixed exchange rate between the ruble and foreign currencies to avoid public turmoil, and a chronic fiscal debt were the reasons that led to the crisis. Does any of this ring a bell?

The Wall Street Journal points out that Russia still has significant foreign exchange reserves to service their debt. However, I believe one look at the charts above show that Wall Street is betting they won’t be enough. The chorus of bears seems to get louder with each move lower in the price of crude.

What is the Right Price for Oil?

That’s really the key question for any investor looking to catch the falling Russian knife. One of the best answers I’ve heard came from CNBC contributor Dennis Gartman who said “oil will keep falling until it stops.”

With oil floating free for the first time in decades I don’t know whether it will settle at 30, 50 or $80 per barrel. But as I told Jeff Macke last week, “I have a strong suspicion it isn’t 100.”