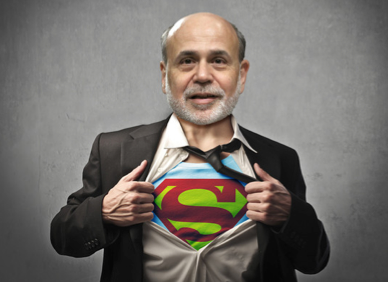

I’ll give you a hint. It isn’t the leader of the free world, the head of the Chinese communist party or the rogue leader of a terrorist state. No, it’s that mild mannered gentleman who every so often steps in front of the cameras and announces what weapons he intends to deploy in his war to stamp out: inflation, deflation, recessions, bubbles, unemployment and any other mandate he chooses to take on.

I’ll give you a hint. It isn’t the leader of the free world, the head of the Chinese communist party or the rogue leader of a terrorist state. No, it’s that mild mannered gentleman who every so often steps in front of the cameras and announces what weapons he intends to deploy in his war to stamp out: inflation, deflation, recessions, bubbles, unemployment and any other mandate he chooses to take on.

I’m of course speaking about Chairman of the Fed Ben Bernanke. The debate rages in Washington and on Wall Street as to his performance but I think most would agree that his actions during the financial crisis helped avoid what could have been the collapse of the U.S. Financial System.

Since then his quantitative easing programs have received mixed reviews. His fans point out that U.S. markets have pushed to all-time highs and inflation has remained in check. However, critics suggest, the rise in markets is unsustainable and that the staggering debt on the Fed balance sheet will prove impossible to unwind and robs from our children’s future.

Let’s assume, for the sake of argument, that Mr. Bernanke’s prescription for our economy and markets is just what the doctor ordered. The fact remains that “The Most Powerful Man on the Planet” isn’t an elected official.

Ben is coming to the end of his term and most agree that he has no intention to continue. As a matter of fact, in a recent interview President Obama said that “Chairman Bernanke has already stayed a lot longer than he wanted or he was supposed to.” That seems like a clear signal he is gone at the end of his term.

It is once again time for the President to choose a replacement. For some time Fed Governor Janet Yellen has been considered the most likely successor. However, recently a name from the past, Larry Summers, has also been mentioned as a candidate. My issue is the following. What if the new “Man or Woman of Steel” isn’t up to the job? Is the entire fate of our nation’s economy tied up in the success or failure of one individual?

Some make comparisons of the Fed to the Supreme Court. After all, Supreme Court Justices aren’t elected. I think the comparison doesn’t hold water because the dirty little secret of the Fed is that despite a 12 member structure it is the Chairman who counts. Alan Greenspan dominated the Fed during his tenure and that tradition seems to have continued during Bernanke’s reign.

Even Superman Makes Mistakes

Just a few weeks ago, Chairman Bernanke stepped before the cameras at the conclusion of the last FOMC meeting. I have to admit he didn’t look well and appeared uncharacteristically nervous before the cameras. At one point he paused for a drink of water in Marco Rubio fashion. After announcing plans to start the “taper” and eventually reduce the $85 Billion per month in purchases he seemed to veer off course with drawn out analogies hoping to better explain his rhetoric. Perhaps sensing like a comic that the performance wasn’t going well, he talked about how we should pretend he is driving in a car and not stepping on the brake but just taking his foot off the accelerator.

Fund managers and traders didn’t buy it and a swarm of sell programs were launched. Stocks, Bonds and Gold fell while interest rates and the dollar rose. In the days following that meeting, a parade of Fed Governors talked to the press trying to walk back the Chairman’s comments. However, the damage had been done.

Then, almost without warning speaking before an audience in Massachusetts, Mr. Bernanke seemed to take back much of what he said at the FOMC meeting. In any event he said, given the weak employment picture and an inflation rate that is below their target “the Fed needs to be more accommodative.” What changed in just a couple of weeks?

Ben Blinked! The markets threw a temper tantrum and like many parents he capitulated.

Markets of course soared on the news and for now stock investors are whispering “God Bless Ben Bernanke.” All of this works flawlessly until one day it doesn’t.

We need to have an honest debate on the structure of the Fed and the power it wields. The current system is an accident waiting to happen and is far too dependent on one individual’s ability to get it right.

Check out my recent Newsmax interviews with Congressman Scott Garrett and Joel Naroff where we discuss Fed Policy.

Disclosure – Funds managed by David Nelson are long Apple stock at the time of the release of this post. however, reserve the right to sell at any time. Belpointe Asset Management, LLC (“Belpointe AM”) is an investment adviser registered with the Securities and Exchange Commission (SEC). Registration with the SEC as an investment adviser should not be construed to imply that the SEC has approved or endorsed qualifications or the services it offers or that or its personnel possess a particular level of skill, expertise or training. For disclosures visit: http://belpointe.com/disclosures/